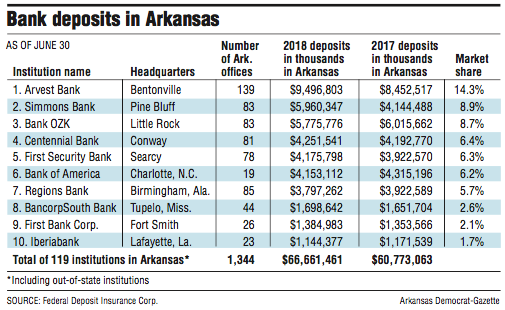

Fayetteville-based Arvest Bank has almost $9.5 billion in deposits in Arkansas, more than any other bank in the state, based on data released Friday by the Federal Deposit Insurance Corp.

The figures are based on information as of June 30.

Arvest's total deposits were a 12 percent increase over the $8.5 billion reported in 2017. Arvest had 14.3 percent of the state's deposits, up from 13.2 percent in 2017.

Deposits are money placed with a bank that includes demand deposits, money market accounts and other savings deposits, time deposits and deposits in foreign offices.

Much of Arvest's growth can be attributed to its purchase of Bear State Financial of Little Rock. Bear State had almost $1.3 billion in deposits in 2017. Bear State's sale to Arvest closed earlier this year.

Arvest has led the state in deposits for the past 12 years, going back to 2007.

"We do like to see growth in deposits -- and households and loans -- annually," said Jason Kincy, a spokesman for Arvest. "You need a balance with deposits and loans to be able to provide what customers need. Especially in this environment, banks are becoming more hungry for deposits, in general."

Arvest has significantly more Arkansas offices than any other bank in the state, 139, while Simmons Bank and Bank OZK, each has 83 branches.

"Although Arvest has more branch locations than any other bank in Arkansas, management of Arvest also has done a good job in attracting deposits in part by offering competitive rates with other banks located in the markets that it serves in Arkansas," said Garland Binns, a Little Rock banking attorney.

Arvest has branches in Arkansas, Oklahoma, Missouri and Kansas.

The 119 banks with offices in Arkansas held $66.7 billion in deposits on June 30, up almost 10 percent from $60.8 billion in 2017.

Simmons Bank of Pine Bluff had the second-highest total of deposits in Arkansas at almost $6 billion. That was more than a 40 percent jump from $4.1 billion in deposits in the state last year.

Determining why Simmons' deposits in Arkansas grew so much was difficult, said Randy Dennis, president of DD&F Consulting Group, a Little Rock bank consulting company.

Simmons did pick up $1 billion of brokered deposits in the past year, Dennis said.

"That could be part of it," Dennis said. "That is almost always domiciled at the main office."

There is nothing to indicate that Simmons bought the brokered deposits, Dennis said. They could have been owned by the banks in Oklahoma and Texas that were acquired by Simmons recently and Simmons just moved the householding of the brokered deposits to the main office in Arkansas, Dennis said.

"It's probably a result of the consolidations [from the acquisitions of Oklahoma and Texas banks]," Dennis said.

A call to Simmons for comment Friday was not immediately returned.

Business on 09/15/2018