Mining Remanufacturing Components Market Size Worth $5.94 Billion, Globally, by 2030 Growing at 4.4% CAGR | Exclusive Report by The Insight Partners

Mining Remanufacturing Components Market share research includes key company profiles like are AB Volvo, Atlas Copco, Caterpiller Inc., Epiroc AB, Hitachi Construction Machinery Co. Ltd., J C Komatsu Ltd., Liebherr Group, Bamford Excavators Ltd., SRC Holding Corporation, and Swanson Industries

/EIN News/ -- US & Canada, March 28, 2025 (GLOBE NEWSWIRE) -- According to a new comprehensive report from The Insight Partners, “the global Mining Remanufacturing Components Market Size and Forecast (2022 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Engine, Axle, Transmission, Hydraulic Cylinder, and Others), Equipment (Excavators, Wheel Loader, Wheel Dozer, Crawler Dozer, Haul Trucks, and Others), and Industry (Coal, Metal, and Others), and Geography”.

For More Information and To Stay Updated on The Latest Developments in The Mining Remanufacturing Components Market, Download The Sample Pages: https://www.theinsightpartners.com/sample/TIPRE00007379/

The report runs an in-depth analysis of market trends, key players, and future opportunities. Trade shows are a robust platform that allows companies to showcase their entire business at one booth, raising company awareness among customers. This is further boosting the market growth.

For Detailed Mining Remanufacturing Components Market Insights, Visit: https://www.theinsightpartners.com/reports/mining-remanufacturing-components-market

Market Overview and Growth Trajectory:

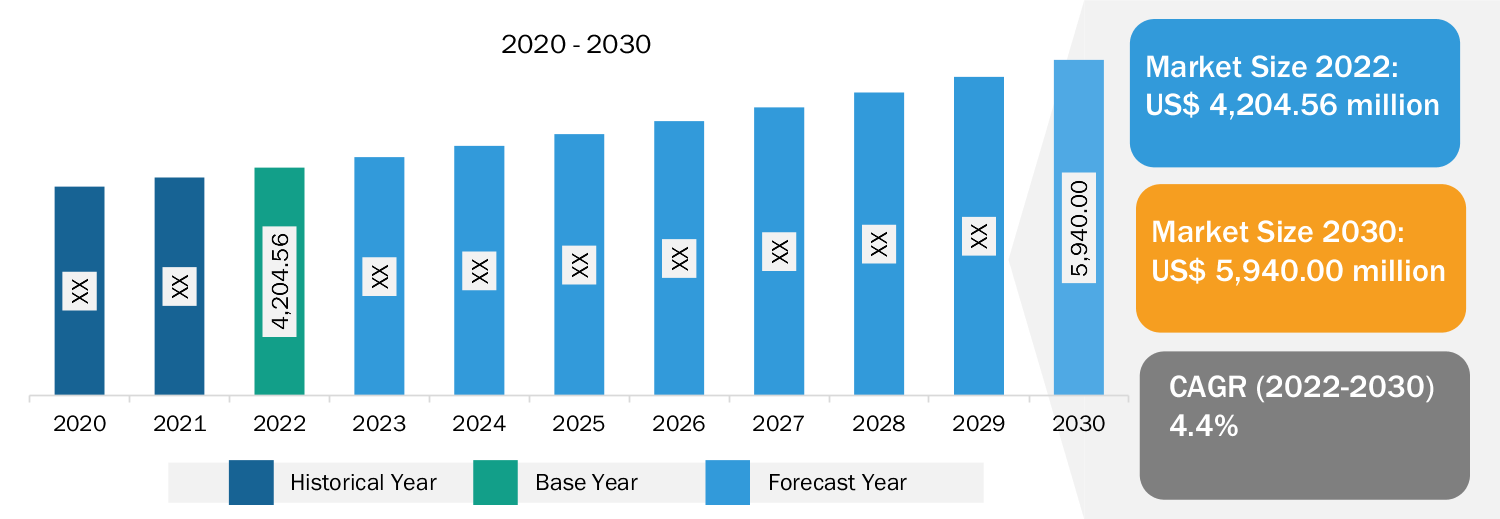

Mining Remanufacturing Components Market Growth: The mining remanufacturing components market was valued at US$ 4.20 billion in 2022 and is projected to reach US$ 5.94 billion by 2030; it is expected to register a CAGR of 4.40% during 2022–2030. The Remanufacturing Industries Council (RIC) is an association of remanufacturing industry sectors and academic institutions based in the US. RIC defines remanufacturing as a comprehensive and rigorous industrial process that restores a previously sold, worn, or non-functional product or component to a “like-new” or “better-than-new” condition and ensures the highest performance level and quality. Remanufacturing a product uses much less energy than new manufacturing of the same component as it reduces or eliminates numerous energy-intensive processes in the new component manufacturing process. Remanufacturing uses fewer raw resources, consumes less energy, and generates less waste than new product development. The reductions in these areas are substantial, resulting in a product of comparable quality that costs less for both the remanufacturer and the end user. As per the head of Liebherr Mining Remanufacturing division, remanufactured components cost up to 60% less or 60% more than new components, and most cost savings come from lower material and energy costs.

Rising Adoption of Electric and Autonomous Vehicles in Mining Industry: The mining sector is beginning to profit from a new generation of low-emission "driverless" mine vehicles that are changing the industry's image and moving it toward decarbonization. Electric vehicles (EVs) are added to fleets for use in both open pit and underground operations by purchasing or refitting existing diesel engine vehicle fleets. Toyota Motor Corp. is at the forefront of developing these new mining vehicles. Toyota and Komatsu launched a cooperative effort in May 2023 to build an autonomous light vehicle (ALV) that will run on Komatsu's GPS-enabled Autonomous Haulage System (AHS). Cool Planet Group, a decarbonization solutions company, announced a US$ 54.2 million deal with a "leading global mining company" in May 2023 to convert 8,500 diesel mining trucks to electric vehicles over the next three years. According to the firm's CEO, up to 1 million diesel mining vehicles must be converted to electricity by 2030. The company is now collaborating with five or six of the world's major mining companies. In addition, WAE Technologies is currently working on the world's largest battery. The battery is intended for use in an electric mining transport vehicle with zero emissions. The company, currently controlled by the Australian mining conglomerate Fortescue Metals Group, is collaborating with the Swiss-German equipment manufacturer—Liebherr—to build an electric mine haul truck weighing up to 240 ton.

Stay Updated on The Latest Mining Remanufacturing Components Market Trends: https://www.theinsightpartners.com/sample/TIPRE00007379/

Growth in Mining Industry in Developed Nations: The mining industry in the US consists of the exploration, extraction, beneficiation, and processing of naturally existing solid minerals from the earth. Coal, metals (such as iron and copper), and industrial minerals are examples of mined minerals. The US is a major producer and user of minerals and metals worldwide. Mined materials are crucial to consumer and industrial technology and define the general industrial expansion of the US. Metal mine production in the US reached US$27.7 billion in 2020, up 3% from 2019. Gold (38%), copper (27%), and iron ore (15%) were the major contributors to the total value of metal mining output in 2020. Per the annual coal data released in October 2023, year on year, coal production in the US climbed 2.9% to 594.2 million short ton (MMst). Further, agreements and collaborations between mining companies and the government have driven the US mining industry. In August 2023, Lynas secured a contract for a heavy rare earth facility. Lynas USA, a subsidiary of Lynas Rare Earths, received a follow-on contract from the US Department of Defense (DoD) to construct a heavy rare earths facility in Texas. The US DoD has increased its commitment to US$ 258 million under the contract to build the heavy rare earth component of Lynas' rare earth processing facility, up from the previously disclosed US$ 120 million contribution. Such government initiatives have driven the mining sector, ultimately supporting the mining industry’s growth.

Additive Manufacturing in Remanufacturing Industry: As one of the major technologies of remanufacturing engineering, additive remanufacturing technology can repair the structure and function of high-value-added key metal parts of large and complex equipment, significantly reducing use and maintenance costs and saving labor and time costs. Additive remanufacturing is a subset of additive manufacturing technology that might restore the size accuracy of damaged parts, increase surface performance, and introduce new surface functions as needed. In the remanufacturing process, additive manufacturing technologies such as laser sintering and thermal spraying are utilized to restore worn parts or cores to their original proportions, and 3D printing is also employed in various ways by remanufacturers. Additive manufacturing is viewed as advantageous in remanufacturing. A few additive manufacturing technologies create standalone parts and can also be used to repair damage or add functionality to an existing item to convert a core to the newest specification. However, additive manufacturing or 3D printing is in the nascent stages in the coming years, and additive manufacturing can be integrated with the remanufacturing process. Many 3D printing and mining vehicle manufacturing companies are taking steps toward using this technology as a mainstream process. In April 2022, Boliden, a Swedish mining business, collaborated with Sandvik Mining and Rock Solutions to test 3D printing technology for machine parts. In addition, Caterpillar, one of the key mining vehicle manufacturers, is also focusing on additive manufacturing for component manufacturing. Thus, the rising adoption of additive manufacturing in the remanufacturing industry is expected to fuel the market growth in the coming years.

Geographical Insights: In 2023, Asia Pacific led the market with a substantial revenue share, followed by Europe and North America, respectively. Asia Pacific is expected to register the highest CAGR during the forecast period.

Mining Remanufacturing Components Market Segmentation, Applications, Geographical Insights:

- On the basis of component, the mining remanufacturing component market is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest market share in 2022.

- On the basis of equipment, the mining remanufacturing component market is segmented into wheel loaders, wheel dozers, crawler dozers, haul trucks, excavators, and others. The crawler dozer segment held a larger share of the market in 2022.

- On the basis of equipment, the mining remanufacturing component market is segmented into wheel loaders, wheel dozers, crawler dozers, haul trucks, excavators, and others. The metal segment held a larger share of the market in 2022.

Key Players and Competitive Landscape:

The Mining Remanufacturing Components Market is characterized by the presence of several major players, including:

- AB Volvo

- Atlas Copco

- Caterpiller Inc

- Epiroc AB

- Hitachi Construction Machinery Co. Ltd.

- J C Komatsu Ltd.

- Bamford Excavators Ltd.

- Liebherr Group

- SRC Holding Corporation

- Swanson Industries

These companies are adopting strategies such as new product launches, joint ventures, and geographical expansion to maintain their competitive edge in the market.

Need A Diverse Region or Sector? Customize Research to Suit Your Requirement: https://www.theinsightpartners.com/inquiry/TIPRE00007379/

Mining Remanufacturing Components Market Recent Developments and Innovations:

- " Komatsu and Toyota to develop autonomous light vehicle that will run on Komatsu’s Autonomous Haulage System Launch collaboration to accelerate autonomy in mining operations.”

- “Komatsu and Honda Jointly Developed the "PC05E-1" electric micro excavator: Expanding the range of models powered by portable and swappable mobile batteries.”

- “SRC Logistics Completes Third Warehouse Expansion Phase.”

Purchase Premium Copy of Global Mining Remanufacturing Components Market Size and Growth Report (2022-2030) at: https://www.theinsightpartners.com/buy/TIPRE00007379/

Conclusion:

Continuous growth in the mining industry and increasing awareness of sustainability are the primary factors driving the demand for mining remanufacturing components. As per the data published by the government officials in 2020, metal mine production in the US reached US$27.7 billion in 2020, up 3% from 2019. Gold (38%), copper (27%), and iron ore (15%) were the major contributors to the total value of metal mining output in 2020. Per the annual coal data released in October 2023, year on year, coal production in the US climbed 2.9% to 594.2 million short ton (MMst). According to the data published by the US Geological Survey in 2019, mines produced ~US$86.3 billion in minerals, more than US$2 billion than the revised 2018 output totals. Metal mining production in the US is expected to reach US$28.1 billion in 2019, up over US$500 million from 2018. In 2019, US domestic production of essential rare-earth mineral concentrates increased by 8,000 metric tons, more than 44% growth from 2018, reaching 26,000 metric ton. Further, according to the Australian Bureau of Statistics (ABS) in 2023, mining delivered a record US$298.64 billion in export earnings to Australia in the fiscal year 2022-23. This sum represents two-thirds of all export revenue for the country and is a 10.5% increase over 2021-22, the previous record year. Such growth in the mining sector of the developed nations has driven the mining remanufacturing component market.

The global mining remanufacturing components market is segmented on the basis of components, equipment, industry, and geography. By components, the market is categorized into engines, axles, transmissions, hydraulic cylinders, and others. Based on equipment, the global mining remanufacturing components market is segmented into wheel loaders, wheel dozers, crawler dozers, haul trucks, excavators, and others. Based on industry, the mining remanufacturing components market is classified into coal, metals, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM).

Related Report Titles:

-

Uranium Mining Market Overview, Growth, and Oppotunities by 2031

-

Copper Mining Market Statistics, Trends, and Key Players by 2031

-

Marine Mining Market Dynamics, Analysis, Growth, Trends, and Opportunities 2031

-

Iron Ore Mining Market Key Vendors, Trends and Forecast by 2031

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/mining-remanufacturing-components-market

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release