Enerflo Announces Strategic Partnership with OneEthos, Powered by Climate First Bank

Streamlined solar financing meets seamless installation: A game-changing integration for homeowners and installers.

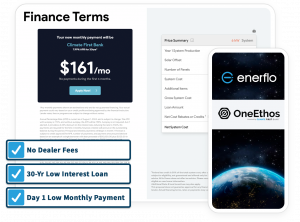

Through this partnership, Enerflo users can offer homeowners access to solar financing with no dealer fees, a 30.5-year term*, and no prepayment penalties, making it the most affordable ethical solar financing option in the nation. Loan origination and processing are provided by Climate First Bank, the world’s first FDIC-insured digital community bank founded to combat the climate crisis, and the fastest growing new bank in the United States since 2009. This integration simplifies the financing process for installers while ensuring homeowners receive affordable solar loan options. Financing is available to all Enerflo partners now - Enerflo partners can access the offering by becoming an approved installer with OneEthos.

Key Benefits for Installers and Homeowners

No Dealer Fees Means Affordable Solar Financing

OneEthos never charges a dealer fee, saving your client up to 30% when financing solar and making the product the most affordable on the market. OneEthos also boasts no prepayment penalties and a 30.5-year term* - maximizing affordability and long-term savings.

Affordable Solar from Day One

By eliminating dealer fees from project costs which can add up to 30% to the cost of solar, the 30.5-year* loan is designed to lower monthly payments, making solar more accessible than ever before. In many cases, homeowners start saving on day one, making it one of the most cost-effective loan options available.

Faster Approvals & 100% Financing

Enerflo’s seamless integration with OneEthos eliminates friction in the loan process—installers can offer 100% financing, and most homeowners receive real-time loan decisions in as little as 30 seconds, accelerating project timelines.

Streamlined Sales & Install Experience

Installers using Enerflo benefit from an all-in-one sales and installation workflow, removing inefficiencies that typically delay solar projects. The financing process is now built directly into the Enerflo sales platform, reducing administrative work and keeping projects moving.

Nationwide Network of Vetted Installers

Homeowners can choose from a trusted network of accredited solar installers, ensuring quality installations that align with the mission of sustainable, responsible energy adoption.

Driving a More Sustainable Future, Together

"We're excited to partner with OneEthos, powered by Climate First Bank to make affordable solar financing more accessible,” said Spencer Oberan, Co-Founder of Enerflo. "This integration allows installers to focus on what they do best—delivering solar solutions and closing deals—while giving homeowners a seamless and affordable financing experience."

"This collaboration between Enerflo and OneEthos represents a major leap forward in making affordable solar financing the new standard," said Marcio deOliveira, Founder & CEO of OneEthos. "Our model provides the nation’s most competitive ethical solar financing program and together, we’re empowering installers to provide their clients with an affordable lending option, creating a more sustainable future for all."

Beyond the technology, the partnership will also include community outreach and education initiatives to drive awareness about sustainable energy solutions and their role in fighting the climate crisis.

*As an example, on a $80,000 loan a homeowner might pay $586.96 per month over 366 months at 8.00% APR. Loans are provided by Climate First Bank, Member FDIC, and are subject to credit check and approval.

About Enerflo

Enerflo is the only Lead-to-PTO, open API Solar Platform, designed to streamline operations for Residential Solar Installers, EPCs, and Sales Dealers. By cutting soft costs, reducing project timelines, and automating workflows, Enerflo helps solar companies deploy more solar efficiently.

Enerflo connects the entire solar sales and installation process into one cohesive, data-driven platform, optimizing lead management, proposals, financing, permitting, and installation. As the backbone of top solar providers, Enerflo powers billions of dollars in solar sales, delivering a fully connected workflow from lead to PTO.

For more information, visit: www.enerflo.com.

About OneEthos

OneEthos is a Certified B Corp, mission-driven fintech company. The company operates at the intersection of financial technology (fintech) and traditional banking with the objective to accelerate the delivery of sustainable and inclusive financial services to all segments of the population. OneEthos is one of the only fintech companies specializing in climate finance in the United States and regulated by the Federal Reserve Bank. The company's mission is to enable Community Banks, Credit Unions, CDFIs, and Green Banks to grow their loan portfolios profitably and responsibly, providing access to banking products and services that have a positive impact on people, communities and the environment.

For more information, please visit: www.oneethos.com.

About Climate First Bank

Recognized as one of the fastest-growing banks in the country, Climate First Bank is the world's first FDIC-insured, values-based, digital community bank founded to combat the climate crisis. A Certified B Corp, 1% for the Planet member, and operationally net-zero since it opened its doors in June 2021, the Bank offers a complete, full-service portfolio of simple and easy-to-use traditional banking products powered by technology to meet the expectations of today's consumers. In addition to offering standard banking services, the company places a special emphasis on non-governmental organizations (NGOs) and businesses committed to sustainability. Eco-conscious customers will find dedicated loan options for solar photovoltaic (PV), energy retrofits and infrastructure to help combat the climate crisis. The Bank reports annually on its impact in line with corporate social responsibility goals; read the most recent Impact Report here. Member FDIC.

For more information, please visit: www.climatefirstbank.com.

Rebecca Taylor

Enerflo

+1 760-214-5549

email us here

Visit us on social media:

Facebook

LinkedIn

Instagram

YouTube

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Energy Industry, Environment, Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release